By Alan Wood

Discover how vintage watch collecting in the UK can offer tax benefits, from CGT exemptions to estate planning advantages, for savvy enthusiasts.

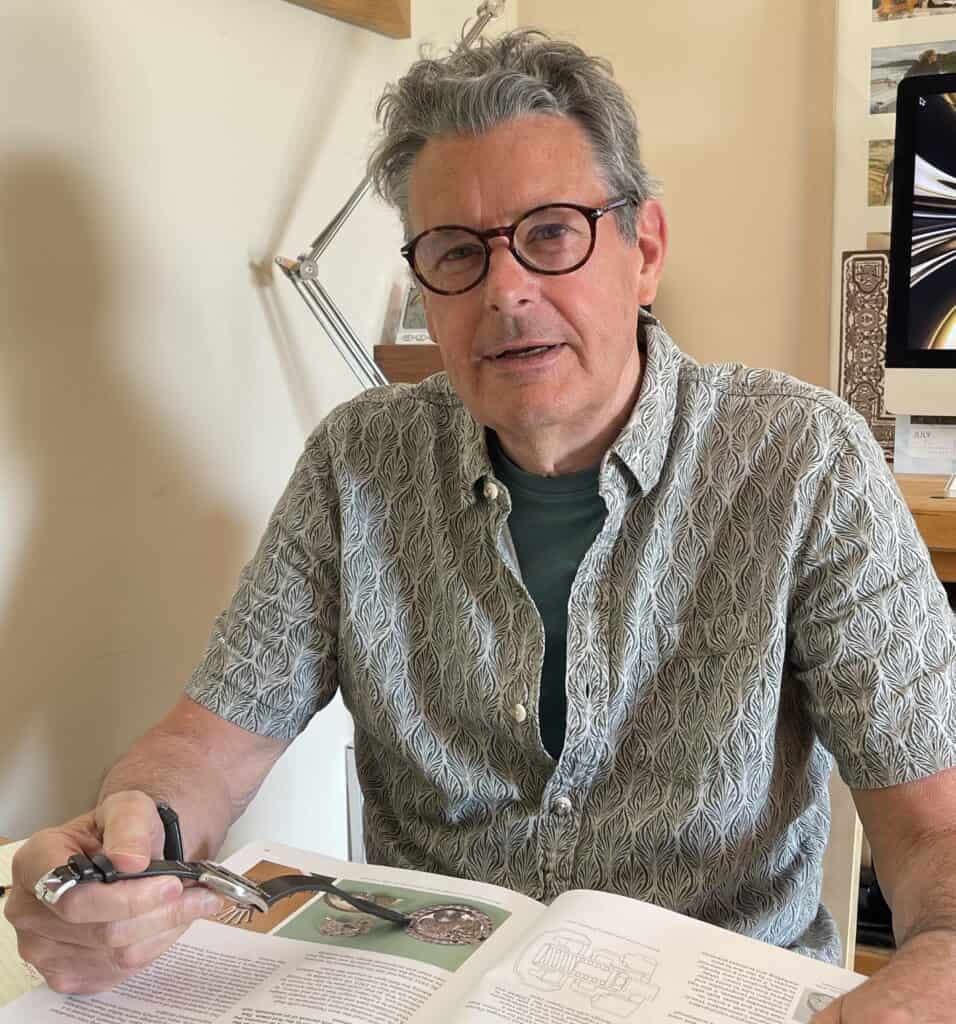

Alan Wood, founder of Vintage Gold Watches, is a trusted vintage watch dealer with over 35 years of private collecting experience. His deep knowledge and infectious passion for mechanical timepieces have earned him a highly respected reputation in the industry. Vintage Gold Watches, established in 2011, has become a reputable dealer thanks to Alan’s expertise and a skilled team of restorers. Alan’s love for vintage watches started as a young Mechanical Engineer and grew into an obsession. He believes the finest watches were made in the 1950s, ‘60s, and ‘70s, and he is thrilled to share them with others.

The Investment Case for Vintage Watches: Style, Substance and Smart Tax Planning

Explore the potential tax advantages of vintage watch collecting, from Capital Gains Tax exemptions to estate planning opportunities for UK-based enthusiasts.

While many collectors are drawn to vintage watches for their design, rarity and craftsmanship, these timepieces offer more than just aesthetic appeal. They can function as tangible, alternative assets – combining personal enjoyment with the potential for long-term value.

For UK-based individuals, vintage watches may serve as both a passion project and a smart addition to a diversified financial strategy.

This article explores how vintage watches can contribute to a tax-aware investment approach, along with key considerations for anyone thinking of making them part of their portfolio.

More Than Sentiment: Wearable, Tangible Wealth

While emotional and aesthetic appeal often take centre stage, vintage watches are more than beautiful heirlooms. They represent tangible, wearable wealth – a rare blend of art, history and mechanical precision that few other assets offer. Unlike stocks or digital investments, vintage watches allow collectors to physically interact with their assets, enjoying them daily while they quietly accrue value.

Brand heritage, limited production runs, original parts and condition all influence a watch’s appeal and long-term investment potential. And because values are shaped by a mix of collector demand and historical significance, these timepieces can appreciate in unique, often less volatile, ways compared to more mainstream asset classes.

For those building a collection, each acquisition isn’t just an indulgence – it’s a curated expression of personal style with the potential for solid returns.

But beyond their collectable charm and intrinsic value, vintage watches can also offer certain tax advantages – particularly in the UK. Understanding how they’re classified for Capital Gains Tax purposes is an important step in assessing their investment potential.

Capital Gains Tax: The ‘Wasting Asset’ Distinction

Under HMRC guidelines, certain tangible items with a predictable lifespan of 50 years or less can be classed as “wasting assets” and many vintage watches meet this definition.

As such:

- Capital Gains Tax (CGT) may not apply when you sell a vintage watch for a profit.

- This can make them appealing for those looking to grow their wealth outside of conventional investment vehicles like shares or property.

For collectors who occasionally buy and sell timepieces, this exemption can make vintage watches a more tax-efficient choice compared to other asset classes.

It is important to note that not all watches will qualify, and specific criteria apply. Always seek professional tax advice tailored to your situation.

Legacy Planning: Timepieces with Meaning and Value

Vintage watches are often passed down through generations – and for good reason. Beyond their market value, they hold emotional weight and personal stories that few other assets can match.

In estate planning, these watches offer:

- Tangible, portable wealth – Unlike property, they don’t require probate delays or valuation complexities.

- Flexibility in inheritance – Valuable watches can be divided among heirs or gifted individually without the administrative burden of larger estate assets.

- Potential IHT advantages – Strategic planning around how and when watches are transferred may help with Inheritance Tax considerations.

In short, vintage watches offer an elegant way to preserve and transfer wealth—both financial and sentimental.

Casual Collector or Trader? Know the Difference

For tax purposes, HMRC makes a distinction between hobbyist collectors and those who regularly buy and sell with the intention of making a profit.

- If you sell watches occasionally, gains are often treated as tax-exempt personal effects.

- If you’re trading regularly, your profits could be considered income and taxed accordingly.

Understanding where you sit on this spectrum is key. A genuine passion for collecting typically falls outside income tax rules, but turning your hobby into a commercial venture brings different obligations.

From Collector’s Cabinet to Financial Strategy

For many, the journey into vintage watches begins with curiosity or nostalgia – perhaps a piece inherited from a family member or spotted in a shop window. But over time, what starts as a passion can evolve into something far more strategic. With increasing awareness around the investment merits of vintage timepieces, more collectors are making informed choices based on market trends, brand trajectories and global demand.

This shift from casual collecting to intentional acquisition doesn’t require abandoning the joy of the hunt. Rather, it adds another layer of appreciation: one grounded in research, valuation insights and long-term thinking.

In this way, a collector’s cabinet can double as a smart, personal financial strategy – rooted in craftsmanship and carried forward with care. Beyond the financial and sentimental value, vintage watches also offer practical advantages that make them a compelling alternative asset.

Other Investment Benefits of Vintage Watches

While tax advantages are a bonus, many collectors are motivated by the intrinsic strengths of vintage watches as an alternative asset:

- Physical ownership – Unlike stocks or crypto, these are assets you can see, wear and enjoy.

- Proven value retention – High-quality models from Rolex, Omega, Patek Philippe and others tend to hold or increase in value over time.

- Inflation resilience – With many vintage watches made of gold or other precious metals, they can serve as a hedge against inflation and market volatility.

- Market stability in uncertain times – Vintage timepieces have historically performed well as collectable assets during economic downturns.

Collecting vintage watches isn’t about chasing short-term gains – it’s about appreciating craftsmanship, rarity and long-term value.

Proceed with Passion and Prudence

Like any investment, entering the vintage watch market requires due diligence. There are no guaranteed returns, and not every piece will rise in value. The most successful collectors tend to:

- Study the market – Understand key brands, reference numbers and provenance factors.

- Verify authenticity – Counterfeits and poorly restored watches can damage your portfolio and your peace of mind.

- Consult advisors – From tax professionals to trusted dealers, expert advice helps protect both your investment and your enjoyment.

Diversification with Distinction

Vintage watches offer an often-overlooked path to diversifying a modern investment portfolio. As physical assets with no ties to the stock market or property sector, their value typically moves independently of traditional financial instruments. This makes them especially attractive during times of market turbulence, when equities fluctuate or inflation bites into the real value of money.

What sets vintage watches apart is their ability to combine form with function – they’re assets that don’t just sit in a vault but can be worn, enjoyed and passed down.

For investors who want their portfolio to reflect personal values or aesthetic sensibilities, watches from renowned brands like Rolex, Omega or Jaeger-LeCoultre provide both visual pleasure and financial credibility.

In short, vintage watches bring a degree of distinction to diversification – something few other asset classes can claim.

Final Word

Vintage watches offer more than aesthetic pleasure – they’re heritage-rich assets with the potential for smart tax positioning. For UK collectors, they can provide Capital Gains Tax relief, play a role in estate planning and avoid income tax if bought and sold casually.

But the greatest value of a vintage watch? It lies in what it represents: enduring craftsmanship, personal taste and the joy of owning something truly timeless.

Stay informed on vintage watch collecting by signing up for the Vintage Gold Watches newsletter, for expert insights, latest arrivals and market trends straight to your inbox.